A-share housing enterprises earned nearly 40 billion yuan in the first quarter, and more than half of them entered the top ten pockets.

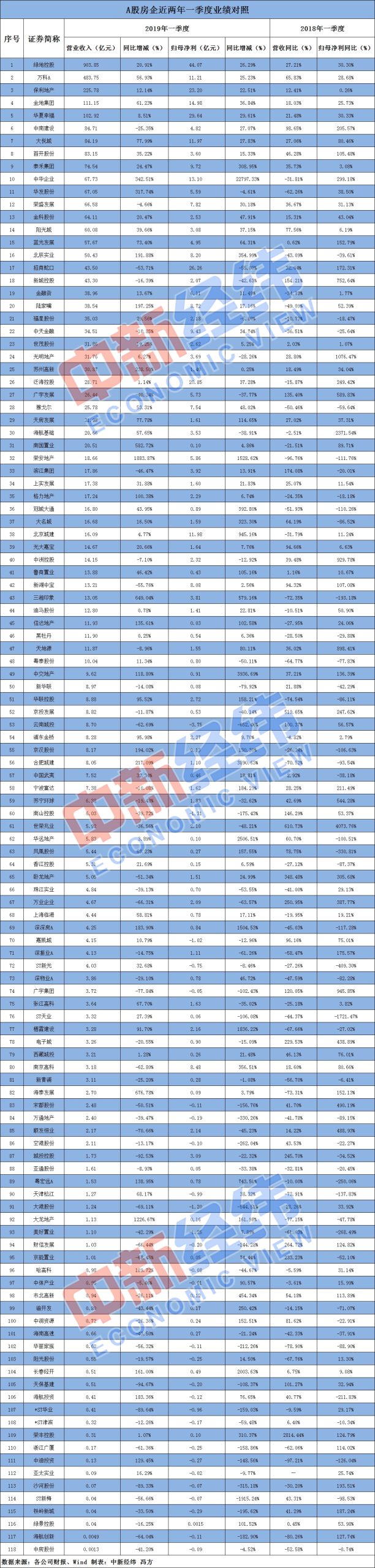

Zhongxin Jingwei Client June 1 ST (Feng Fang) According to a quarterly report disclosed by listed companies, 118 real estate development enterprises listed on A-shares achieved a profit of 37.867 billion yuan in the first quarter, among which the profits of the top five housing enterprises in revenue accounted for over 30%, and the profits of the top ten housing enterprises in net profit accounted for over 50%.

The top ten real estate enterprises with net profit earned half of the money.

According to the classification of Wind industry, 90 of the above 118 real estate enterprises made profits in the first quarter, accounting for 76.27%. 28 companies suffered losses in the first quarter, accounting for 23.73%.

Among them, the revenue of five housing enterprises exceeded 10 billion, namely Greenland Holdings (90.385 billion yuan), Vanke A (48.375 billion yuan), Poly Real Estate (22.578 billion yuan), gemdale (11.115 billion yuan) and Huaxia Happiness (10.293 billion yuan). The real estate enterprises ranked at the bottom generally earned less than 100 million yuan in the first quarter, and the bottom of Zhongfang shares even realized a revenue of only 130,000 yuan. If Greenland Holdings, which ranks first in revenue, is taken as an example, its daily average revenue of 1.004 billion yuan is higher than that of 71 real estate enterprises in the first quarter.

It is worth mentioning that the total profit of the above 118 real estate enterprises in the first quarter was 37.867 billion yuan, and the total profit of the five real estate enterprises with revenues of over 10 billion yuan was 12.310 billion yuan, accounting for over 30%, reaching 32.51%; The top ten housing enterprises earned a total of 20.726 billion yuan, accounting for more than half, reaching 54.74%.

According to media reports and institutional data, the concentration of the real estate industry continued to increase last year, and the "head effect" was highlighted. Judging from the proportion of total assets, the total assets of the top 17 enterprises account for more than 50%, and the total assets of the top 55 enterprises account for more than 80%. In addition, in the first four months of 2019, the value of TOP10 real estate enterprises accounted for 42% of the top 100, and the trend of industry differentiation is still intensifying.

Some insiders have analyzed that in the future, with the continuous market pressure and the further emergence of the competitive advantages of brand housing enterprises, housing enterprises will face higher requirements in terms of investment layout, financing ability and internal control.

The performance of many housing enterprises has increased dramatically.

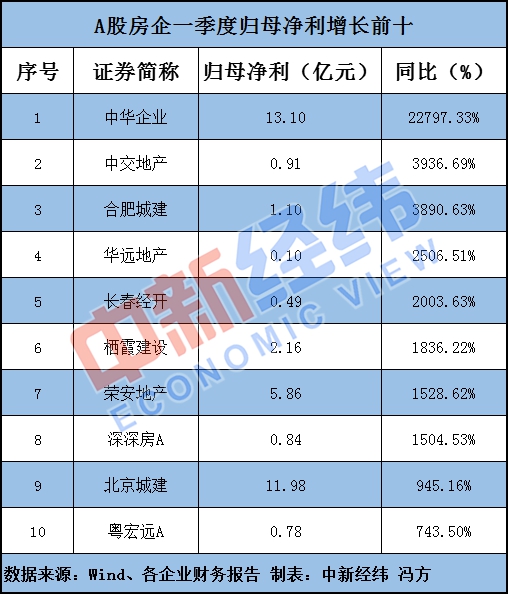

According to the financial data, the performance of a number of real estate enterprises increased by more than 500% in the first quarter, among which the financial indicators of some real estate enterprises increased by more than 1000%, and the net profit of some enterprises increased by nearly 228 times year-on-year.

In terms of revenue year-on-year, in the first quarter, Rong ‘an Real Estate increased by 1883.87%, Dalong Real Estate increased by 1226.67%, Haitai Development increased by 676.78%, Sanxiang Impression increased by 649.04%, and Nanguo Real Estate increased by 582.72%, all of which exceeded 500%.

Judging from the year-on-year net profit of returning to the mother, the number of enterprises whose index changed by more than 500% in the first quarter increased significantly. Among them, the net profit of Chinese enterprises in the first quarter changed the most, with a year-on-year increase of 22,797.33%. In addition, ST Xinmei’s net profit in the first quarter decreased by 1915.24%, Yunnan Chengtou decreased by 652.46%, and Dagang shares decreased by 544.51%.

For the case of large changes in performance, several real estate enterprises with large changes in revenue have given corresponding explanations. For example, Rongan Real Estate explained that the revenue growth in the first quarter was 1883.87%, mainly due to the delivery of the company’s Xinshangyuan project. Among the real estate enterprises with large changes in net profit, only Chinese enterprises, Beijing Urban Construction, Yuehongyuan A and Dagang Co., Ltd. explained the reasons, while CCCC Real Estate, Hefei Urban Construction, Shenfang A and Yunnan Chengtou did not explain the changes in net profit.

According to Chinese enterprises, the company’s net profit attributable to its mother in the first quarter increased by 22,797.33% year-on-year, mainly due to the significant increase in operating income carried over by the company during the reporting period compared with the same period of last year, and the increase in gross profit margin compared with the same period of last year. According to the financial report of Chinese companies, Chinese companies lowered their net profit for the first quarter of 2018, from 47 million yuan to 06 million yuan, a difference of several times.

Regarding the reasons for the adjustment, Chinese enterprises said that on April 23, 2018, the company issued shares to the controlling shareholder Shanghai Real Estate (Group) Co., Ltd. and paid cash to purchase 100% equity of Shanghai Zhongxing (Group) Co., Ltd. (hereinafter referred to as "Shanghai Zhongxing") to complete the transfer. 100% equity of Shanghai Zhongxing is a business combination under the same control. According to the requirements of accounting standards, the company makes retrospective adjustments to the relevant financial statements.

"Xiaoyangchun" has spread, and the Ministry of Housing and Urban-Rural Development and experts have shouted.

The data shows that among the above-mentioned 118 real estate enterprises, 65 had a year-on-year increase in revenue in the first quarter, accounting for more than half, and nearly 80% had a year-on-year increase in net profit. Behind the performance growth of housing enterprises is the recovery of the real estate industry.

Previously, the national real estate development investment and sales from January to March 2019 released by the National Bureau of Statistics showed that in March, the real estate development prosperity index was 100.78, an increase of 0.21 points over February, and the index also rose slightly in February compared with January.

It has been reported that the property market "Xiaoyangchun" is spreading with the help of "Golden Three Silver Four".

In April this year, Li Yujia, a senior researcher at the Shenzhen Real Estate Research Center and a researcher at the Bank Research Center of Sun Yat-sen University, pointed out that combined with the data, the property market sales that had already entered the downward channel showed signs of reversal. If it is simply a "small spring", that is, the seasonal release of accumulated demand in the early stage, there is nothing wrong with it, but this time the hype atmosphere is very strong.

In April, Sheng Songcheng, former director of the Survey and Statistics Department of the People’s Bank of China, said that after the Spring Festival in 2019, many media reported that the real estate market began to pick up. At present, the real estate market in some cities has shown a warming trend, and the macroeconomic situation is also conducive to rising house prices. Sheng Songcheng pointed out that we should persist in real estate regulation and control and guard against a new round of housing price rise.

According to Xinhua News Agency on May 18, the Ministry of Housing and Urban-Rural Development issued early warning reminders to six cities on April 19, and also issued early warning reminders to Foshan, Suzhou, Dalian and Nanning, where the price index of newly-built commercial housing and second-hand housing has increased significantly in the past three months.

The Ministry of Housing and Urban-Rural Development requires that all localities should resolutely implement the decision-making arrangements of the CPC Central Committee and the State Council, always adhere to the positioning that houses are used for living, not for speculation, further strengthen market monitoring and analysis, solve problems in market operation in time, and earnestly implement the requirements of stabilizing land prices, housing prices and expectations to ensure the stable and healthy development of the real estate market.

Schedule: