How are the two "leading companies" of Huawei, Cyrus and Shenzhen O-film Tech Co.,lt, coming to the top in a row?

A-share market since October, smart car andThe two main lines are far ahead, bySeries connection

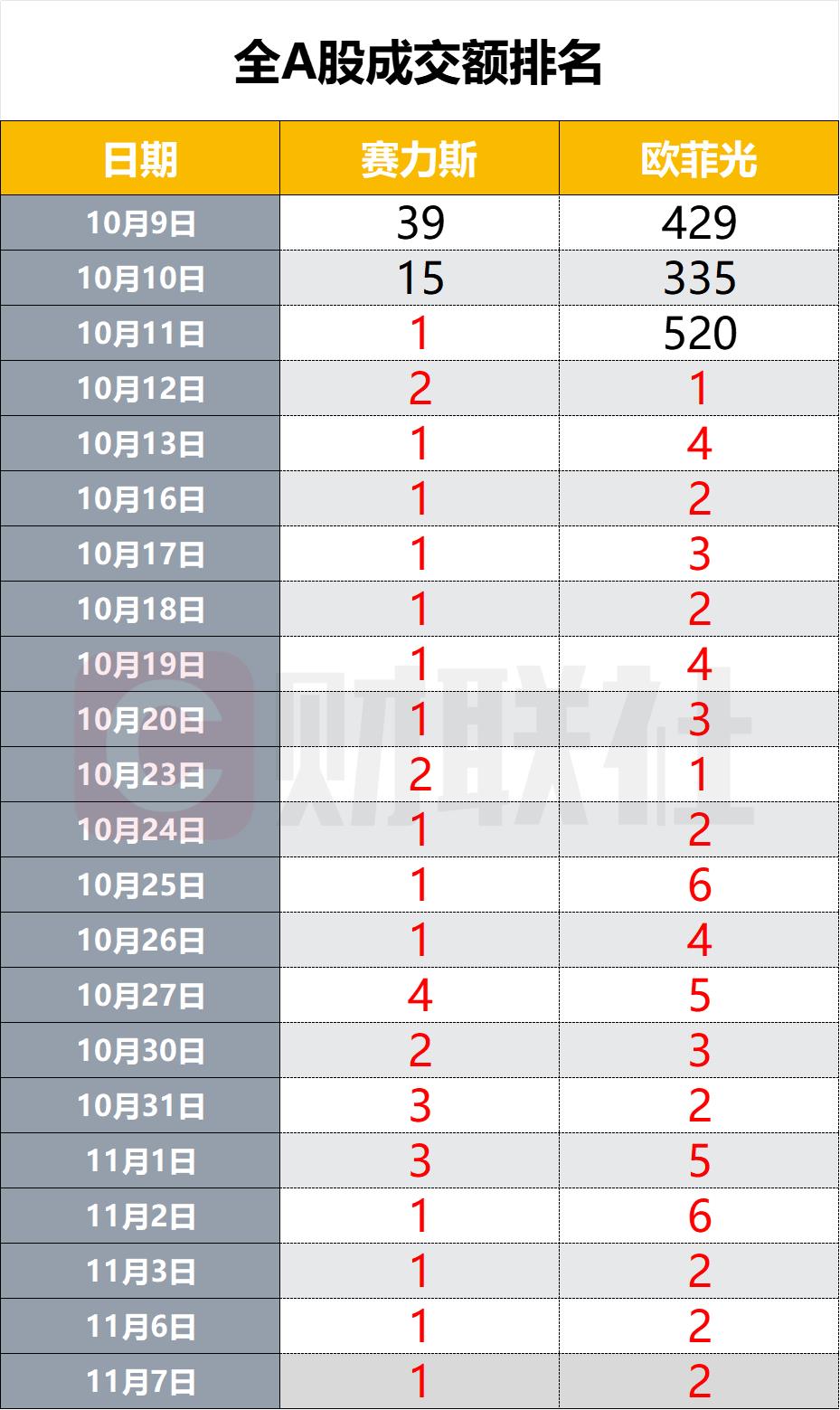

From the perspective of the rhythm of capital "joining forces", it benefits from the hot sales of the new M7 in the world.Out of the "fruit chain" into Huawei’s mobile phone supply chainThe "Zhongjun", which has become two main lines respectively, has been in the top ten turnover of the two cities for 20 trading days.

Specifically,In the 22 trading days after the Eleventh Golden Week, the total A-share turnover was on the top ten list for 20 consecutive trading days, with an average daily turnover of 8.76 billion; After 19 trading days on the list, the average daily turnover was 7.22 billion.. In the two trading days this week, the single-day turnover exceeded 10 billion.

Looking back at the smart car market, since the Golden Week in November 2023, Huawei Smart Car has been asking for a new M7, which continues to detonate the hot spot in the secondary market. Not only did it break through 80,000 units on the 50 th day of listing, but the market was also extrapolated to every subdivision concept of the smart driving industry chain.

About, in earlier September, Huawei Mate 60 Pro won a "full house" with technological breakthroughs, which made Huawei’s mobile phone sales in the third quarter increase by 37% year-on-year, and also led to a rebound in the upstream and downstream industrial chains. In the fourth quarter, Xiaomi 14 continued to detonate the smart phone market in China, and related concepts relayed the main wave.

Why are the funds "joining forces" and Cyrus?

In the "Eye of the Storm" center where Huawei’s industrial chain market is surging, Cyrus and Shenzhen O-film Tech Co.,lt in the third quarter.All have improved. In the third quarter of 2023, Cyrus was still losing money, but the sales volume of its brand Q3 increased by 36.42% month-on-month, among which the M7 model increased by 303% month-on-month. In the third quarter of 2023, Shenzhen O-film Tech Co.,lt turned losses into profits after deducting non-net profit from the previous quarter, which is the first year-on-year loss since it was kicked out of the "fruit chain" in early 2021, and the northbound fund Q3 also greatly increased its position.

Judging from the logic of individual stocks and the industrial chain behind them, the two turnover lists are different.

Cyrus: Huawei’s smart selection model has made great strides.

On November 7th, Celeste, whose market value has reached a new high, hit a maximum of 99.97 yuan."Once only one step away.

Looking back at the last round of large-scale market of Cyrus in 2022, it is also closely related to the M7. At the end of May, 2022, after Yu Chengdong announced that it would release M7, the share price of Celeste (then known as Xiaokang Shares) rose by 85% in 21 trading days. However, the sales volume of the first-round M7 model opened higher and went lower last year.

On September 12th, this year, the new M7 with HUAWEI’s advanced intelligent driving system was "killed" and returned to the market, which made Cyrus’s share price increase by 112% within 35 trading days.

Looking back, Cyrus started cooperation with Huawei in 2019. The cooperation mode between Huawei and the whole vehicle is mainly divided into three modes, such as HI/ Intelligent Selection, and the intelligent vehicle selection mode between Cyrus and Huawei is the deepest cooperation mode.Ni yujingThe viewpoint is that under the narrative of "Huawei",The highlight of cooperation promotion lies in cooperation and communication and product design. At present, the cooperation and coordination have matured, and the intelligent core competitive advantage is expected to continue to drive the company to cooperate with Huawei to start a strong vehicle cycle..

In terms of collaboration and communication, in July 2023, Huawei and Cyrus jointly established a joint working group on sales and service, and Huawei was responsible for the end-to-end closed-loop management of sales business; M7, the delivery terminal, has basically realized the delivery of new cars as soon as they are launched, and the production capacity has climbed and the delivery rhythm has been significantly improved.

In terms of product design, the prices of the five-seat standard version and six-seat standard version of the new M7 are lowered by 40,000 yuan and 20,000 yuan respectively compared with the old M7 standard version. Under the background of broadening the use scene of the smart driving version, the space and safety of the model are upgraded.

Shenzhen O-film Tech Co.,lt: Out of the "fruit chain" into Huawei’s supply chain, the canoe has passed Chung Shan Man.

The beginning of 2021 is the "darkest hour" in Shenzhen O-film Tech Co.,lt. After being kicked out of the "fruit chain" in early 2021, Ou Feiguang’s share price plummeted and its performance turned into a loss.

In the third quarter of this year, Shenzhen O-film Tech Co.,lt finally saw the dawn. On September 28th, it was reported that Shenzhen O-film Tech Co.,lt camera modules entered the Mate 60 series supply chain of Huawei mobile phones, accounting for the vast majority, including rear camera, front camera and fingerprint module, with a single unit value of 500-600 yuan. In addition, in order to ensure the stability of order production, Oufeiguang Nanchang Factory added several production lines.

Since September 28th, the share price of Ou Feiguang has doubled in 23 trading days. After the release of Q3 results, the share price has rebounded to the level before leaving the "fruit chain".

In the third quarter of 2023, Shenzhen O-film Tech Co.,lt achieved revenue of 4.505 billion yuan, a year-on-year increase of 47.75% and a quarter-on-quarter increase of 24.49%; Realize ownership54.32 million yuan, a year-on-year loss, an increase of 1136.73%; Realized a non-net profit of 4.557 million yuan, turning losses year-on-year.

Ou Feiguang once told the Cailian reporter that at present, Ou Feiguang is based on the steady development of smart phone business, accelerating the development of innovative businesses such as smart cars and new fields, extending to the upstream of the industrial chain, opening up new markets, and building smart phones. The business architecture system of smart cars and new fields.

What did Huawei Smart Drive or Huawei Mobile Phone bring?

Wang Lingtao said that Huawei Mate 60 Pro has drivenDomestic mobile phones have entered a stage of arms development competition in the field of high-end machines, which is obviously a good thing for the supply chain.Moreover, Huawei has invested more resources in camera, screen, satellite communication and other sub-areas that can open up the application experience with other brand models, which is also the recent Huawei supply chain system such as Shenzhen O-film Tech Co.,lt.、When these targets can get out of the independent market, they have laid the groundwork.

Judging from the market sentiment and feedback, this expectation has gradually begun to expand and diverge:Other targets in Huawei’s direct or indirect supply chain have also begun to attract market attention, and the market sentiment has spread from Huawei’s supply chain system to "the recovery of the whole consumer electronics".

In terms of intelligent driving,Li Muhua said that domestic smart driving supply chain manufacturers will also benefit from the rise of Huawei’s ecology. With the centralization of EE architecture, the requirement for core competence of core suppliers has changed from full-stack integration ability to customized development and adaptation ability according to the needs of OEMs. The demand of the main engine factory for electrification and intelligence is rising. In this process,The gap between domestic manufacturers and overseas head manufacturers has been greatly narrowed. With the gradual maturity of Huawei’s ecology, it will bring more opportunities for domestic supply chain manufacturers to participate in the wave of automobile intelligence..

Wang Lingtao said that in the past year and a half or even two years, there have been many industry targets whose profits have been declining due to the decline in demand, the global division of trade frictions, and the epidemic situation. The targets that have fallen for more than one year abound, and this kind of low chip position,In the current trend of expectation reversal driven by Huawei, and under the background that the third quarterly report of the industry has indeed improved, there is both continuous space and continuous motivation.. Obviously, in Huawei’s supply chain (including consumer electronics and vehicle-mounted terminals), in addition to the above-mentioned targets, there are many varieties that can continue to be observed.In the current market atmosphere, the head enterprises in a certain segment of Huawei’s supply chain still have the expected difference of continuing to be excavated and learned..