After Corolla is overtaken by Model Y, Camry will also face Tesla’s pursuit

The fall of the giant seemed like an instant.

On April 25, 2014, Microsoft announced the completion of its acquisition of Nokia. Nokia CEO Jorma Ollila said at a press conference: "We did nothing wrong, but we lost somehow." After speaking, he couldn’t help but cry.

In 1999, Nokia’s market capitalization reached 203 billion euros, making it the most valuable company in Europe. In the first five years of the 21st century, Nokia’s global mobile phone market share reached 72.8%.

Such a global giant said collapse, it is not its business is not fine or operational problems, simply because iPhone brought the mobile phone into the new era, and Nokia did not keep up.

Now, the auto industry appears to be playing the same game.

Toyota, the Japanese carmaker that has been the world’s biggest seller by sales for almost a decade, has held back from the electrification trend even as its carefully built walls are torn down brick by brick by rivals. And it is the pure electric vehicle makers – BYD and Tesla – that have eroded its turf.

As early as 2020, Tesla’s market value surpassed that of Toyota and became the world’s largest car brand by market value.

Not only the company’s market value, but in the first quarter of 2023, the Tesla Model Y surpassed the Toyota Corolla to become the best-selling model in the world.

In the Chinese market, BYD also relied on the BYD Qin DM-i Champion Edition with the same price of gasoline and electricity to kill the joint venture brand that had long been entrenched in the A-class car market, and even became the all-category sales champion in April this year, further weakening Toyota’s position.

The bad news came one after another. In the United States, Toyota’s largest single market, its competitiveness is also facing challenges. Recently, according to foreign media reports, Tesla Model 3 can now receive full federal subsidies and state subsidies, and the price after subsidies is even lower than that of Toyota Camry.

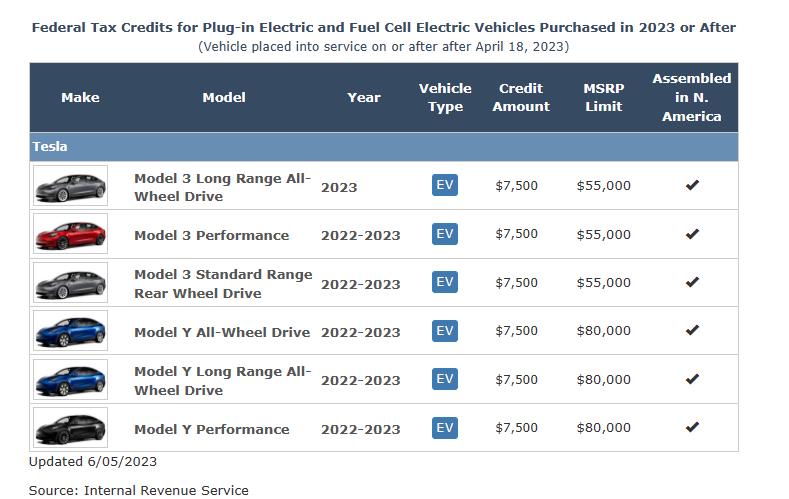

Previously, the US government’s low-carbon bill mentioned that if new energy vehicles want to receive full government subsidies, they must ensure that the proportion of key components produced in the United States or by American companies in the supply chain reaches a certain level. According to the bill, last year, Tesla Model 3 standard battery life rear-wheel drive version and long-life four-wheel drive version could only receive half of the subsidy, or $3,750. The reason is that it used CATL batteries in its entry-level models at that time, but CATL does not currently have a battery factory dedicated to Tesla in North America, so it does not meet the criteria for receiving full subsidies.

After being adjusted by suppliers, the car began to use batteries from Panasonic’s US factory, which allowed it to receive a full $7,500 federal subsidy and a $7,500 state subsidy in California.

According to sources, the cost of the CATL battery is lower than that of Panasonic’s battery, but compared to the additional $3,750 per vehicle subsidy, this cost difference can be ignored.

Now, a Model 3 starting at $40,240 can be priced as low as $25,240 after subsidies, while the Camry is priced at $26,320 in the United States. This undoubtedly has a huge sense of pressure on the latter. You know, the 2022 Toyota Camry is the 5th best-selling model in the United States, with annual sales 295,200.

A large part of the reason for such high sales is that it is nearly $10,000 cheaper than the Model 3. But now, with the Model 3 cheaper than itself, the Camry’s price competitiveness has undoubtedly declined significantly.

In the Chinese market, the Camry is also Toyota’s main model, with sales of 249,000 in 2022. In China, you can buy a Camry for 17 or 80,000 yuan, while the price of the Model 3 starts at 230,000 yuan. Imagine if, like in the United States, the price of the Model 3 in China drops to a starting price similar to that of the Camry, and a number of joint venture B-class cars including the Camry, Accord, and Teana will undoubtedly be mourned.

It can be said that the Japanese brands led by Toyota are being squeezed by new energy vehicles on a global scale, but as the previous Toyota president and the current Toyota president, Akio Toyoda still insists on his views. Last year, he accused those all in electric car companies of being the "silent majority", believing that they just follow the crowd and have no opinions.

Akio Toyoda, the chairman of the Japan Automobile Manufacturers Association, recently attracted the attention of the industry again when he joined a number of Japanese companies to boycott electric vehicles. At the recent G7 summit in Japan, Akio Toyoda once again emphasized his opposition to the full electrification of vehicles, and was supported by a number of Japanese exhibitors, including Suzuki, Isuzu, Yamaha Honda and Mazda.

"The strength of the Japanese auto industry lies in the diversity of technologies such as battery electric vehicles, hydrogen and hybrids," Mr. Toyoda said at a press conference. "We need to be close to the reality of each country and region, respect differences and live with diversity. To do this, we need a variety of technologies. Japanese companies should refine their unique technological advantages and improve their competitiveness. I believe the multiple avenues of the Japanese auto industry are to use the technology where it is needed."

Gill Pratt, Toyota’s chief scientist and CEO of Toyota Research Institute, has also previously said that transitioning to electric vehicles too quickly may cause some owners to continue using older gasoline vehicles, and that traditional gasoline-electric hybrids should continue to be given some time.

As we all know, the gasoline-electric hybrid is Toyota’s housekeeping skill. Since 1997, it has undergone five generations of technological updates, which can be said to be its strongest moat in the era of electrification. However, globally, electrification refers more to plug-in and pure electrification, which is completely different from Toyota’s unplugged oil-hybrid technology.

Therefore, Toyota, which is still the world’s first car company, has shown its determination to be all in electric from time to time, but its determination to compete with pure electric vehicles is not as firm as other competitors.

For example, at the end of last year, Toyota showcased 16 pure electric vehicles in one go, intending to demonstrate that it has a strong reserve of pure electric technology and can produce a lot of pure electric vehicles in minutes. However, it was later exposed by the media that among the 16 vehicles displayed, 5 cars in the first row were sludge models, and the 11 cars behind were fuel vehicles changed to new energy vehicle livery.

At the Shanghai Auto Show in April this year, Toyota released its latest strategy in China, saying that all R & D and product decisions on electric vehicles can be made by Toyota China without discussing with the Japanese headquarters. But this is only a move for the Chinese market, because in the eyes of the Japanese, Chinese user requests are a "special existence" in the world. Few other countries have such high demand for sofas, refrigerators, and large screens in cars, so they set up an electric vehicle team for this market to test the water and see what the development of "off-the-shelf" can bring.

But it is still not as fast as its Chinese rivals. The two bZ series concept cars launched by Toyota at the Shanghai Auto Show will not be launched in FAW Toyota and GAC Toyota until 2024. And as its main models are smashed by Chinese and American electric vehicle competitors one by one, can Toyota, which promotes the diversity of power forms, still hold its breath?